Apply for Car Finance in Swindon and Cirencester

Personal Car Leasing and Funding Options

Here at Pebley Beach, we understand that finance can be confusing, but don't worry. Even though we offer a wide range of finance options to help everyone buy their dream car, we're committed to assisting customers in finding the right solution to suit their budget and needs.

When you browse our site looking for a new or used car, it’s likely that you’ll come across lots of car financing options that may leave you scratching your head and unsure which finance option is right for you - or even whether you should get your car on finance in the first place! That's why We've created a short video to get you started.

- Quick and very convenient service

- Free no obligation quote

What is Personal Contract Hire (PCH)?

The easiest way to think of PCH is the leasing option. If you aren't looking to own a vehicle outright, and you're happy to hand it back to the finance company at the end of the term, then Personal Contract Hire could be right for you. To get started you’ll need to agree the annual mileage allowance according to your needs, the higher the allowance the higher the monthly payment will be. Then you pay an advance rental payment which is normally low and equivalent to a few monthly payments.

When the paperwork has been signed and you collect your vehicle, you’ll simply pay the agreed monthly rental payment for the fixed term, usually 2 or 3 years. Often customers choose to add a service and maintenance costs as well as road tax into the agreement, so all your motoring costs are rolled into one monthly payment making budgeting easier. When the agreement comes to an end, you simply hand the car back and if the vehicle is in good condition and hasn’t exceeded the agreed mileage allowance, there will be no further costs to you.

What is Personal Contract Purchase (PCP)

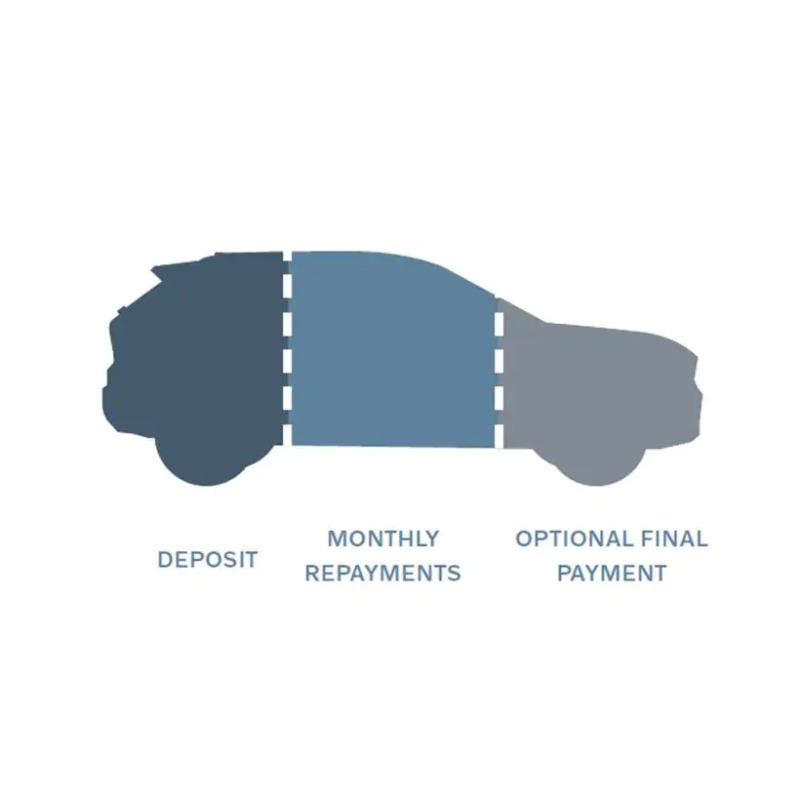

This finance solution is a popular choice for customers, especially if you have a vehicle to part-exchange or funds for a deposit, would like to have various options at the end of the agreement and prefer lower monthly payments. Initially, at the start of the agreement, customers pay a deposit which can be cash or made up from your part-exchange vehicle. The larger the deposit the smaller the monthly payments will be. When the deposit is paid and the agreement is signed, the customer will pay the agreed monthly payments for the duration of the contract which is normally 2-4 years.

When the agreement end, these are your options:

- Return the car. If the car is in good condition and hasn’t exceeded the mileage allowance, no further payments are required.

- Keep the car and buy it outright. The price will be determined by the guaranteed minimum future value (GMFV) which is set at the beginning of the agreement and any option to purchase fees that may apply.

- Part exchange/swap the car for a brand-new vehicle with a new agreement.

What is Hire Purchase (HP)?

Hire purchase (HP) is available to both private individuals and companies who wish to purchase a vehicle outright. It can be used to fund the purchase of both new cars and used cars. Designed to allow the purchase cost of a vehicle to be spread over a period of time, it makes budgeting easier and results in you becoming the legal owner at the end of the finance term.

At the start of the agreement a deposit will be paid, usually you will pay cash, part exchange your old vehicle or you can do a combination of both. The higher the initial deposit the lower the monthly payments will be. The fixed regular monthly payment and the term length will then be agreed depending your circumstances and preferences. With no deferred lump sum to pay at the end, you will become the legal owner of the vehicle once all the monthly payments and any Option to Purchase fees have been paid. Another benefit of a HP finance agreement is that there won't be an annual mileage limit.

Paying a Deposit

When you find the right car and make the decision to finance the purchase, that has a high monetary value, whether that’s a new car, or a used car for example, you might be asked to put a deposit down. This deposit secures the item to be sold to you and not another person - and it also helps to lower the total cost of what you pay per month on your finance agreement.

You’ll agree with Pebley Beach an initial deposit, as well as your agreement term and monthly repayments. In some instances, the finance lender can offer zero deposit options, which can be helpful if you have limited savings when you’re looking to purchase a new or used car.

Frequently Asked Questions

- Can you apply for car finance to be in joint names? No. If you're applying for car finance, it must be in your name only.

- Can I part exchange my current car? Yes. To find out more about part exchanging your car, head to our part exchange page..

- Can car finance be paid off early? Yes – but you may have to pay a fee for early termination, depending on the lender.

- Can I get car finance if I have bad credit? It’s not guaranteed; however, we work with a variety of lenders to find the right deals for our customers.

- Can you buy used cars on finance? Yes – find out more about the different car finance options above by enquiring using the button below.

Find your perfect car now.

We've got thousands of cars to choose from, all in one place - and that's right here.

Enquiry About Financing Your Next Car